The real estate industry has long been characterized by opacity, complex processes, and information asymmetries that favor insiders over ordinary investors. Traditional real estate transactions involve multiple intermediaries, lengthy paper trails, and limited visibility into property performance and management decisions. Blockchain technology is fundamentally changing this landscape, introducing unprecedented levels of transparency and accountability that are reshaping how we think about real estate investment and management.

The Transparency Challenge in Traditional Real Estate

Traditional real estate investment suffers from several transparency limitations that have persisted for decades:

Information Asymmetries

In conventional real estate markets, information is often concentrated among a small group of industry professionals, including brokers, developers, property managers, and institutional investors. Individual investors typically have limited access to comprehensive market data, property performance metrics, or detailed financial information about their investments.

This concentration of information creates significant disadvantages for individual investors, who must rely on limited public information and the representations of intermediaries when making investment decisions. The lack of comprehensive, real-time data makes it difficult to assess true property values, compare investment opportunities, or monitor ongoing performance effectively.

Opaque Fee Structures

Traditional real estate investments often involve complex fee structures that can be difficult for investors to understand and track. Management fees, acquisition fees, disposition fees, and performance fees can significantly impact returns, but investors may have limited visibility into how these fees are calculated and applied.

These opaque fee structures can lead to situations where investors are surprised by the total cost of their investments or discover that fees are higher than initially understood. The complexity of these structures also makes it difficult for investors to compare the true costs of different investment opportunities.

Limited Performance Visibility

Once invested in a traditional real estate fund or partnership, investors typically receive quarterly or annual reports with limited detail about property-level performance. This lack of real-time visibility makes it difficult for investors to assess the quality of management decisions or the true performance of their investments.

The delayed and limited nature of traditional reporting means that investors may not discover problems with their investments until significant time has passed, reducing their ability to take corrective action or make informed decisions about future investments.

Complex Ownership Structures

Traditional real estate investments often involve complex legal structures with multiple layers of entities, making it difficult for investors to understand their actual rights and the true ownership structure of the underlying assets.

These complex structures can obscure the relationship between investor contributions and actual property ownership, making it difficult for investors to understand their rights, assess their risks, or verify that their interests are being properly protected.

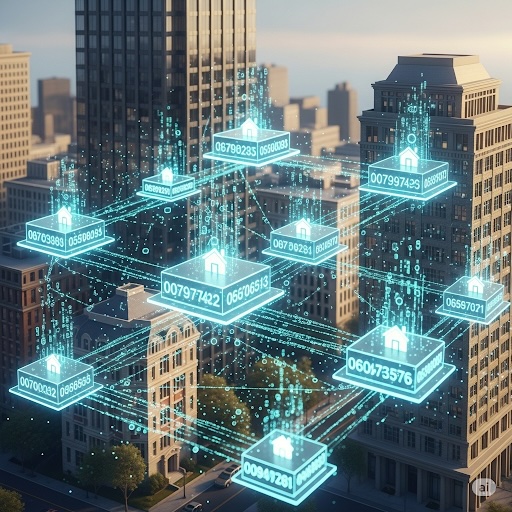

How Blockchain Enhances Transparency

Blockchain technology addresses these transparency challenges through several key mechanisms that fundamentally change how information is recorded, stored, and accessed in real estate transactions:

Immutable Transaction Records

Every transaction related to a tokenized real estate investment is recorded on the blockchain, creating an immutable and publicly verifiable record of all activity. This includes:

- Property Acquisitions: Complete records of how properties were acquired, including purchase prices, transaction details, due diligence findings, and the rationale for investment decisions

- Income Distributions: Transparent tracking of all rental income collection and distribution to token holders, including timing, amounts, and any deductions or fees

- Expense Management: Detailed records of all property-related expenses, including maintenance, improvements, management fees, and how these expenses impact investor returns

- Management Decisions: Documentation of key management decisions, including the decision-making process, alternatives considered, and expected outcomes

This immutable record-keeping eliminates the possibility of retroactive changes to transaction history and provides investors with complete confidence in the accuracy and completeness of their investment records.

Real-Time Performance Monitoring

Blockchain-based real estate platforms can provide real-time visibility into property performance through automated data collection and reporting systems that far exceed the capabilities of traditional reporting methods:

- Occupancy Rates: Live tracking of property occupancy, lease status, tenant turnover, and vacancy periods with immediate updates as conditions change

- Rental Income: Real-time collection and distribution of rental payments, including tracking of late payments, partial payments, and collection efforts

- Operating Expenses: Immediate visibility into property operating costs, maintenance expenses, capital improvements, and their impact on net operating income

- Market Performance: Continuous benchmarking against comparable properties, market indices, and performance targets with automated alerts for significant deviations

This real-time monitoring capability enables investors to stay informed about their investments on a continuous basis rather than waiting for periodic reports, allowing for more timely decision-making and better portfolio management.

Smart Contract Automation

Smart contracts can automate many aspects of real estate management while providing complete transparency into how decisions are made and executed:

- Automated Distributions: Smart contracts can automatically distribute rental income to token holders based on predetermined formulas, eliminating delays and ensuring consistent, fair distribution

- Expense Approval: Automated approval processes for routine expenses while requiring token holder approval for major expenditures, with all approval processes recorded on the blockchain

- Performance Triggers: Automatic execution of predetermined actions when certain performance thresholds are met or missed, such as triggering additional marketing efforts when occupancy falls below target levels

- Compliance Monitoring: Automated monitoring of compliance with investment guidelines, regulatory requirements, and contractual obligations

Enhanced Accountability Through Blockchain

Beyond transparency, blockchain technology also enhances accountability in real estate investment by creating new mechanisms for investor oversight and management accountability:

Governance and Voting Rights

Tokenized real estate can provide investors with enhanced governance rights through blockchain-based voting systems that are more accessible, transparent, and verifiable than traditional governance mechanisms:

- Major Decision Voting: Token holders can vote on significant decisions such as property improvements, refinancing, disposition, or changes to management strategy

- Management Oversight: Regular voting on management performance, fee structures, and continuation of management agreements

- Transparent Voting: All votes are recorded on the blockchain, ensuring that voting results cannot be manipulated

- Proportional Representation: Voting power is automatically calculated based on token ownership, ensuring fair representation for all investors

Performance-Based Management

Blockchain technology enables new forms of performance-based management compensation that align manager incentives with investor outcomes:

- Automated Performance Fees: Smart contracts can automatically calculate and distribute performance fees based on actual property performance against predetermined benchmarks

- Clawback Provisions: Automated clawback of fees if performance targets are not met over specified time periods, ensuring that managers are held accountable for long-term performance

- Benchmarking: Automatic comparison of management performance against industry benchmarks, peer properties, and historical performance with transparent reporting of results

- Incentive Alignment: Smart contracts can implement sophisticated incentive structures that reward managers for achieving specific performance targets while penalizing underperformance

Regulatory Compliance Monitoring

Blockchain systems can provide enhanced regulatory compliance monitoring that reduces compliance risks and provides greater assurance to investors:

- Automated Compliance Checks: Smart contracts can automatically verify compliance with investment restrictions, regulatory requirements, and contractual obligations

- Audit Trails: Complete, immutable audit trails for regulatory examinations and compliance reviews that cannot be altered or destroyed

- Real-Time Reporting: Automated generation of regulatory reports and filings with real-time data that ensures accuracy and timeliness

- Exception Monitoring: Automated monitoring for compliance exceptions with immediate alerts and corrective action protocols

The Impact on Investor Confidence

The enhanced transparency and accountability provided by blockchain technology is having a significant impact on investor confidence and market development:

Reduced Information Risk

Investors can make more informed decisions with access to comprehensive, real-time information about their investments. This reduces the risk of unpleasant surprises and enables better portfolio management through:

- Complete Information Access: Investors have access to the same information as managers, eliminating information asymmetries

- Real-Time Updates: Immediate notification of material changes or developments affecting investments

- Historical Analysis: Complete historical data enables better analysis of trends and patterns

- Comparative Analysis: Ability to compare performance across different properties and managers

Improved Trust

The immutable nature of blockchain records and the transparency of smart contract operations helps build trust between investors and platform operators. Investors can verify that their interests are being properly represented and that management is acting in accordance with stated policies.

This improved trust is particularly important in attracting new investors to real estate who may have been hesitant to invest due to concerns about transparency and accountability in traditional structures.

Enhanced Due Diligence

The comprehensive data available through blockchain platforms enables more thorough due diligence, both at the time of initial investment and on an ongoing basis. Investors can:

- Verify Claims: Independently verify performance claims and representations made by managers

- Assess Track Records: Analyze detailed historical performance data for managers and properties

- Monitor Ongoing Performance: Continuously monitor investment performance against expectations and benchmarks

- Identify Red Flags: Early identification of potential problems or concerning trends

Challenges and Considerations

While blockchain technology offers significant transparency benefits, there are also challenges and considerations that must be addressed:

Privacy Concerns

The public nature of blockchain records can raise privacy concerns, particularly for high-net-worth individuals who may prefer to keep their investment activities private. Platforms must balance transparency with legitimate privacy needs through:

- Selective Disclosure: Providing transparency on relevant investment information while protecting personal privacy

- Anonymization Techniques: Using techniques to anonymize personal information while maintaining transaction transparency

- Privacy Controls: Allowing investors to control what information is publicly visible

Technical Complexity

The technical complexity of blockchain systems can be intimidating for some investors, potentially creating new forms of information asymmetry between technically sophisticated and less technical investors. This challenge requires:

- User-Friendly Interfaces: Intuitive interfaces that make blockchain transparency accessible to all investors

- Education and Training: Comprehensive investor education about blockchain technology and its benefits

- Technical Support: Robust technical support to help investors navigate blockchain-based platforms

Regulatory Uncertainty

The regulatory framework for blockchain-based real estate investments is still evolving, creating uncertainty about future compliance requirements and potential changes to transparency obligations. This requires:

- Proactive Compliance: Staying ahead of regulatory developments and implementing best practices

- Regulatory Engagement: Active engagement with regulators to help shape appropriate frameworks

- Flexibility: Building systems that can adapt to changing regulatory requirements

Best Practices for Blockchain Transparency

Successful implementation of blockchain transparency in real estate requires adherence to several best practices:

User-Friendly Interfaces

While the underlying blockchain technology may be complex, investor-facing interfaces should be intuitive and easy to understand, making transparency accessible to all investors regardless of technical sophistication. This includes:

- Dashboard Design: Clear, intuitive dashboards that present complex information in an accessible format

- Mobile Accessibility: Mobile-optimized interfaces that allow investors to access information anywhere

- Customization Options: Ability for investors to customize their information display based on their preferences and needs

Comprehensive Data Standards

Platforms should adopt comprehensive data standards that ensure all relevant information is captured and presented in a consistent, comparable format. This includes:

- Standardized Metrics: Consistent calculation and presentation of key performance metrics

- Data Quality Controls: Robust processes to ensure data accuracy and completeness

- Industry Standards: Adoption of industry-standard data formats and reporting conventions

Regular Auditing

Even with blockchain transparency, regular third-party audits remain important to verify that systems are operating as intended and that data integrity is maintained. This includes:

- Smart Contract Audits: Regular audits of smart contract code and functionality

- Data Integrity Audits: Verification that blockchain data accurately reflects real-world conditions

- Process Audits: Review of operational processes and controls

Privacy Protection

Platforms should implement appropriate privacy protections to balance transparency with legitimate privacy concerns, potentially through techniques such as zero-knowledge proofs or selective disclosure mechanisms.

The Future of Real Estate Transparency

As blockchain technology continues to mature and adoption increases, we can expect to see even greater levels of transparency and accountability in real estate investment:

Industry Standardization

We anticipate the development of industry standards for blockchain-based real estate transparency, making it easier for investors to compare opportunities across different platforms and properties. These standards will likely include:

- Data Standards: Standardized formats for property data, financial reporting, and performance metrics

- Transparency Standards: Industry-wide standards for what information should be transparent and how it should be presented

- Governance Standards: Best practices for investor governance and decision-making processes

Integration with Traditional Systems

Blockchain transparency systems will likely integrate more closely with traditional real estate systems, including MLS databases, property management software, and financial reporting systems. This integration will:

- Reduce Data Entry: Eliminate duplicate data entry and reduce the risk of errors

- Improve Data Quality: Ensure consistency between different systems and data sources

- Enhance Functionality: Enable new capabilities through the combination of blockchain and traditional systems

Enhanced Analytics

The wealth of data available through blockchain systems will enable more sophisticated analytics and insights, helping investors make better decisions and optimize their portfolios. This will include:

- Predictive Analytics: Using historical data to predict future performance and identify opportunities

- Risk Analytics: More sophisticated risk assessment and management tools

- Portfolio Optimization: Advanced tools for optimizing real estate portfolio allocation and performance

Regulatory Evolution

Regulatory frameworks will continue to evolve to address the unique characteristics of blockchain-based real estate investments, potentially mandating certain transparency standards and practices. This evolution will likely include:

- Transparency Requirements: Specific requirements for what information must be transparent and how it should be presented

- Governance Standards: Requirements for investor governance and decision-making processes

- Technology Standards: Standards for blockchain technology implementation and security

Conclusion

Blockchain technology is fundamentally transforming transparency and accountability in real estate investment, addressing long-standing information asymmetries and creating new standards for investor protection and engagement. While challenges remain, the benefits of enhanced transparency are clear: better-informed investors, improved trust, and more efficient markets.

The implementation of blockchain transparency represents more than just a technological upgrade—it represents a fundamental shift toward a more democratic, accessible, and fair real estate investment ecosystem. By eliminating information asymmetries, reducing opacity, and creating new mechanisms for accountability, blockchain technology is leveling the playing field between institutional and individual investors.

At RealPort, we've built transparency and accountability into every aspect of our platform, from initial property selection and due diligence through ongoing management and eventual disposition. We believe that transparency is not just a technological capability, but a fundamental responsibility to our investors and the broader real estate investment community.

Our commitment to transparency extends beyond simply making information available—we strive to make that information accessible, understandable, and actionable for all our investors. We believe that informed investors make better decisions, and better decisions lead to better outcomes for everyone involved in the real estate investment process.

The future of real estate investment is transparent, accountable, and accessible. Blockchain technology is making that future possible today, creating opportunities for investors to participate in real estate markets with unprecedented visibility and confidence. As this technology continues to evolve and mature, we expect to see continued growth and innovation in tokenized real estate investment.

The transformation is already underway, and the benefits are becoming increasingly clear. Enhanced transparency leads to better investment decisions, improved market efficiency, and greater investor confidence. As more platforms adopt blockchain technology and transparency becomes the standard rather than the exception, we expect to see continued growth and innovation in tokenized real estate investment.

The real estate industry has always been built on trust, but that trust has traditionally been based on relationships, reputation, and limited information. Blockchain technology is creating a new foundation for trust based on transparency, verifiability, and accountability. This new foundation is stronger, more reliable, and more accessible than what came before, creating opportunities for a more inclusive and efficient real estate investment ecosystem.