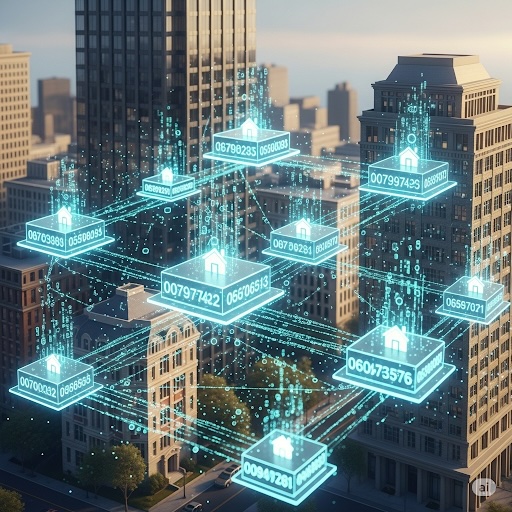

The real estate industry has long been characterized by complex processes, multiple intermediaries, lengthy transaction times, and significant costs that can make property investment inaccessible to many potential investors. Smart contracts are changing this landscape fundamentally, offering a new paradigm where transactions can be executed automatically, transparently, and with unprecedented efficiency.

What Are Smart Contracts in Real Estate?

Smart contracts are self-executing contracts with terms directly written into code that runs on a blockchain network. In the context of real estate, they automate the execution of agreements when predetermined conditions are met, eliminating the need for traditional intermediaries while ensuring all parties fulfill their obligations according to the agreed-upon terms.

At RealPort, we leverage smart contracts to streamline every aspect of the tokenization process, from initial asset verification and token creation to ongoing dividend distributions and secondary market transactions. Our smart contracts are designed to handle the complex requirements of real estate investment while maintaining the security, transparency, and efficiency that blockchain technology provides.

Key Benefits of Smart Contract Implementation

1. Elimination of Intermediaries

Traditional real estate transactions involve numerous intermediaries, each adding cost, complexity, and potential points of failure to the process. These intermediaries include real estate brokers, escrow agents, title companies, legal representatives, and various administrative service providers.

Smart contracts can automate many of these functions, significantly reducing costs and transaction times while eliminating the risk of human error or fraud. For example, a smart contract can automatically verify that all conditions for a property transfer have been met, execute the transfer of ownership, and distribute funds to the appropriate parties without requiring manual intervention from multiple intermediaries.

2. Enhanced Transparency

Every transaction and condition is recorded on the blockchain, creating an immutable audit trail that provides unprecedented transparency for all parties involved. This transparency extends beyond just the transaction itself to include all aspects of the property's performance and management.

Investors can track their investments in real-time, from initial purchase through ongoing performance and eventual exit. They can see exactly how rental income is collected and distributed, how expenses are managed, and how property values are determined.

3. Automated Compliance

Smart contracts can be programmed with regulatory requirements built-in, ensuring that all transactions comply with relevant securities laws, KYC/AML requirements, and investor accreditation standards. This automated compliance reduces the risk of regulatory violations while streamlining the compliance process for all parties.

Real-World Applications at RealPort

Our smart contracts automatically handle the entire tokenization workflow, from initial asset verification and token creation to distribution and governance. When properties generate rental income or are sold, smart contracts automatically calculate and distribute returns to token holders based on their ownership percentage.

The smart contracts also handle more complex scenarios, such as capital improvements, refinancing, and partial property sales. They can automatically calculate the impact of these events on token holders and adjust distributions accordingly.

The Future of Real Estate Transactions

Smart contracts represent more than just a technological upgrade for real estate transactions; they're a fundamental reimagining of how real estate can be owned, traded, and managed. By removing friction, reducing costs, increasing transparency, and enabling new forms of automation, smart contracts are making high-quality real estate investment accessible to a broader range of investors than ever before.

As smart contracts become more widely adopted in real estate, we expect to see increasing integration with traditional real estate systems and processes. This includes integration with MLS systems, property management software, and traditional financial systems.

Conclusion

The implementation of smart contracts in real estate is still in its early stages, but the potential for transformation is enormous. As the technology continues to mature and regulatory frameworks become more established, we expect to see even greater adoption and innovation in this space.

At RealPort, we've seen firsthand how smart contracts can transform the real estate investment experience. Our platform demonstrates that it's possible to maintain the fundamental benefits of real estate investment while dramatically improving the efficiency, transparency, and accessibility of the investment process.