The Economics of Fractional Ownership

Fractional ownership fundamentally changes the economics of asset investment by lowering barriers to entry while maintaining the benefits of direct ownership.

Breaking Down Barriers to Entry

Traditional asset ownership often requires substantial capital commitments that exclude many potential investors. A commercial real estate property worth $10 million, for example, typically requires significant equity investment even with leverage, limiting participation to institutional investors and high-net-worth individuals.

Fractional ownership through tokenization can reduce minimum investments to hundreds or thousands of dollars rather than millions. This democratization of access creates new market dynamics and expands the potential investor base dramatically.

Portfolio Diversification Benefits

Lower minimum investments enable investors to diversify across multiple assets and asset classes with the same capital that would previously be concentrated in a single investment. This diversification can significantly reduce portfolio risk while maintaining return potential.

An investor with $100,000 can now potentially own fractions of dozens of properties across different geographic markets and property types, rather than being limited to a single local investment or indirect exposure through REITs.

Liquidity Premium Reduction

Traditional alternative assets carry a liquidity premium - investors demand higher returns to compensate for the inability to easily exit their positions. Fractional ownership with secondary market trading can significantly reduce this liquidity premium.

The ability to trade fractional interests on secondary markets means investors no longer need to commit capital for the entire lifecycle of an asset. This increased liquidity can reduce required returns and increase asset valuations.

Transaction Cost Efficiency

Traditional asset transactions involve substantial costs including legal fees, due diligence expenses, and intermediary commissions. These costs are often fixed regardless of transaction size, making small investments economically inefficient.

Tokenization can dramatically reduce transaction costs through automation and standardization. Smart contracts can handle many functions previously requiring expensive intermediaries, while standardized processes reduce due diligence and legal costs.

Market Efficiency and Price Discovery

Fractional ownership markets can improve price discovery for underlying assets by creating more frequent trading activity and transparent pricing information. This increased market efficiency benefits all participants through better valuation accuracy.

More liquid markets also reduce bid-ask spreads and improve execution quality for investors. The increased transparency and efficiency can attract additional capital to asset classes that were previously considered too illiquid or opaque.

Governance and Control Considerations

Fractional ownership necessarily involves sharing control and decision-making authority. The economic benefits of fractional ownership must be weighed against the potential loss of direct control over asset management decisions.

Token-based governance systems can provide fractional owners with voting rights proportional to their ownership stakes. However, the practical implementation of governance in fractional ownership structures requires careful consideration of decision-making processes and minority investor protection.

Tax Implications and Optimization

The tax treatment of fractional ownership can be complex, particularly when ownership is structured through tokens or other digital representations. Different jurisdictions may treat tokenized ownership differently from traditional ownership structures.

However, fractional ownership can also create new tax optimization opportunities. Investors can more easily harvest losses, rebalance portfolios, and manage their overall tax exposure through strategic trading of fractional interests.

Technology Infrastructure Costs

While fractional ownership reduces many traditional costs, it introduces new technology infrastructure requirements. Blockchain networks, smart contract development, and platform maintenance all involve ongoing costs that must be factored into the economic equation.

These technology costs are often fixed or have significant economies of scale, meaning they become more economically efficient as the platform grows and processes more transactions.

Market Maturity and Network Effects

The economics of fractional ownership improve as markets mature and achieve greater scale. Network effects mean that platforms with more users and assets can offer better liquidity, lower costs, and more diverse investment opportunities.

Early-stage fractional ownership markets may face challenges with liquidity and price discovery, but these issues typically improve as the market develops and attracts more participants.

Risk-Return Profile Changes

Fractional ownership can alter the risk-return profile of asset investments in several ways. Increased liquidity and diversification opportunities can reduce risk, while lower barriers to entry may attract less sophisticated investors who require additional protections.

The ability to exit positions more easily may also change investor behavior, potentially leading to more short-term focused decision-making that could impact long-term asset performance.

Future Economic Implications

As fractional ownership becomes more widespread, it could fundamentally reshape asset markets and investment behavior. The democratization of access to alternative assets may lead to new forms of wealth creation and more equitable distribution of investment returns.

The long-term economic implications of fractional ownership are still unfolding, but the potential for creating more efficient, accessible, and liquid asset markets represents a significant opportunity for both investors and the broader economy.

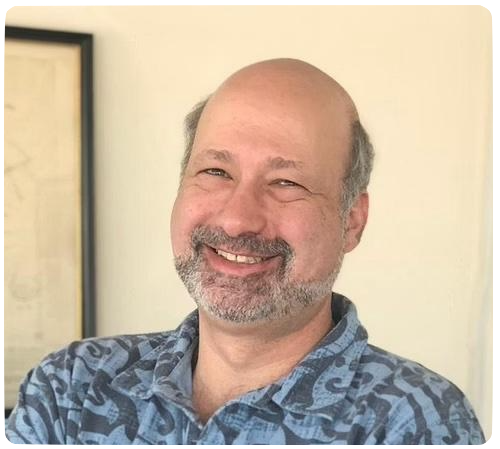

Michael Staw

Co-Founder & CTO

A blockchain architect and technology innovator with deep expertise in smart contracts, fintech, and cybersecurity. Michael focuses on creating transparent, automated solutions that bridge traditional finance with Web3 innovation.

Related Articles

Secondary Markets: Unlocking Liquidity for Tokenized Assets

Discover how secondary markets are revolutionizing liquidity for tokenized assets...

Read More →

Building Trust in Decentralized Finance

Explore the key factors that contribute to building trust in the DeFi ecosystem...

Read More →